北欧绿色邮报报道(记者陈雪霏)--斯德哥尔摩小区的玫瑰花不多,但是非常香甜。比买的玫瑰花要更大,更香,更甜,更鲜艳。

呼伦贝尔蒙古包的夕阳!

https://www.youtube.com/watch?v=X3IQ4G4JSIU

北欧绿色邮报报道(记者陈雪霏)--因为想帮助画家陆大有找一个合作伙伴搞一个画展,我采取了一个比较笨的办法,就是到几个有可能的老城区和富人区去看画廊。先看了东城,又看了南城。最后来到老城。

老城可真是个迷。尽管我在这里呆了八年,但我没有经常去逛街,所以很多地方对我来说依然很新鲜,很好玩。我走了好几家咖啡画廊。就是咖啡厅,但也展示画。但我看的显然和陆大师的风格不一样。但有一个画廊老板很好,他说他自己有太多画家,但有个地方可以出租。

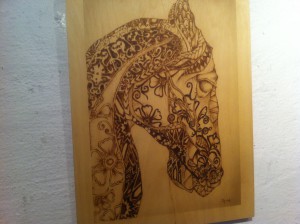

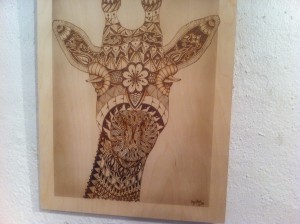

于是,我沿路走到那里。老城的小拳头大的石头路真的和苏州老街上的路是一样的,古色古香。我进门一看,一个年轻的瑞典小伙子坐在那里。墙上都是烫画。他告诉我他是用很结实的白桦树木板烫画的。

于是,我沿路走到那里。老城的小拳头大的石头路真的和苏州老街上的路是一样的,古色古香。我进门一看,一个年轻的瑞典小伙子坐在那里。墙上都是烫画。他告诉我他是用很结实的白桦树木板烫画的。

我问他是否从小就开始喜欢画画。于是,他滔滔不绝地和我聊了起来。原来,他是在中部银雪平的穆塔拉市出生的,在那里上完中学,有人说你应该到大城市斯德歌尔摩去,那里有更多的工作机会。于是他高中毕业就选择学习两年的教师资格。然后,在索尔纳市小学找到了工作,那就是教小学生画画和手工课。

我问他是否从小就开始喜欢画画。于是,他滔滔不绝地和我聊了起来。原来,他是在中部银雪平的穆塔拉市出生的,在那里上完中学,有人说你应该到大城市斯德歌尔摩去,那里有更多的工作机会。于是他高中毕业就选择学习两年的教师资格。然后,在索尔纳市小学找到了工作,那就是教小学生画画和手工课。

业余时间,他和弟弟妹妹三人一起租了一个画室。在画室里他可以自己作画,也可以集中教课。例如每天6小时,每次两天的课程,他可以一次收费4000克朗。

业余时间,他和弟弟妹妹三人一起租了一个画室。在画室里他可以自己作画,也可以集中教课。例如每天6小时,每次两天的课程,他可以一次收费4000克朗。

因此,他在这里展出并没有卖出多少作品,但是,他发现如果把他的作品做成明信片,便宜点儿卖,他还卖了一些。但是,3000-5000克朗的作品在一周内几乎没有卖出去。他这是第二次自己展售。

因此,他在这里展出并没有卖出多少作品,但是,他发现如果把他的作品做成明信片,便宜点儿卖,他还卖了一些。但是,3000-5000克朗的作品在一周内几乎没有卖出去。他这是第二次自己展售。

丹尼尔. 乔治在画廊。 陈雪霏拍摄。

“其实,我这也是自我宣传。来这里看我作品的人可以拿一个名片,然后,他们可以看我的网站,对我的作品点赞,日久天长,我知道他们喜欢我的什么作品,然后,我可以通过其他方式赚钱。当然,我本来就有工作嘛。”

甲壳虫乐队主唱约翰赖侬。不幸被一个疯子歌迷谋杀。

猫王。

迈克尔杰克逊。

功夫大师李小龙。

他说他的一个朋友就是在朋友圈卖作品,结果还真卖出去不少。“我没有那么多朋友,所以,我还需要努力”。

他说,目前他还是自己掏成本费,增值税部分可以从税务局那反回来,如果他不赚钱的话。

他是用电笔在木板上烫画动物,飞鸟,他也画飞鸟。他还画著名歌星的肖像,例如约翰.莱浓,猫王,迈克尔.杰克逊和李连杰等明星。

他是用电笔在木板上烫画动物,飞鸟,他也画飞鸟。他还画著名歌星的肖像,例如约翰.莱浓,猫王,迈克尔.杰克逊和李连杰等明星。

他说,他就是喜欢画,也希望更多人喜欢他的作品。

图文 陈雪霏

BEIJING, July 8 (Xinhua) — A BRICS group with deepened cooperation will not only serve its five member countries and other developing nations, but also stabilize and even boost the world economy.

In upcoming days, leaders of the BRICS countries — Brazil, Russia, India, China and South Africa — will meet in Ufa of Russia for the seventh BRICS leaders meeting.

They met for the first time in 2009, launching the bloc’s cooperation mechanism. Since then, the BRICS have shown vitality and innovation through cooperation, with deepened participation in global governance.

Now these countries will set up the New Development Bank (NDB). The institution’s board of governors will hold its first meeting in Moscow to appoint members of the board of directors and the management.

The NDB shows that the BRICS bloc has transformed from a political concept to a real force for reform in the international community.

With the bank’s funding, developing countries, especially the African states, can improve their infrastructure, rather than struggling with the limited funds the current international agencies provide them.

The new development bank will cover the shortcomings of the global financial system. It is not intended to overturn the current system, but to encourage investment from developed countries and other developing countries with an open and inclusive mind.

The BRICS has become an importance platform for exchanges and cooperation among the world’s major emerging economies. It has brought real benefits for the member states, and also earned a good reputation among the international community.

This new cooperation mechanism pointed to an important trend: emerging economies are playing bigger roles in global issues.

Global economic recovery remains slow. While trade globalization agreements are still being negotiated, the Western countries and Russia are introducing sanctions against each other, and the developed and developing countries have not yet reached agreement on how to balance economic development and climate change.

Under such circumstances, the BRICS leaders’ meeting in Ufa has critical significance as cooperation among them will not benefit not only themselves but also the world economy.

Although the five countries are at very different stages of their development, they will still become new growth poles for the world economy.The five have contributed half the world’s economic growth in the past 10 years.

They have complementary industrial structures. Sufficient labor, abundant resources and large markets give them great opportunities for development.

The five countries are also important players in both their continents and international affairs. In multilateral platforms such as the UN and the G20, they are playing bigger roles than ever before, thus their booming economies can drive the whole global economy through their deepened cooperation with other countries and international organizations. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

BEIJING, June 29 (Xinhua) — A China-initiated multilateral bank that has dominated media headlines for months took a key step forward on Monday, with the signing of an agreement that outlines the framework and management structure for the institution.

Representatives of the 57 prospective founding countries of the Asian Infrastructure Investment Bank (AIIB) gathered in Beijing for the signing ceremony in the Great Hall of the People. Australia was the first country to sign the document.

The 60-article agreement specified each member’s share as well as the governance structure and policy-making mechanism of the bank, which is designed to finance infrastructure in Asia.

Seventy-five percent of the bank’s share is distributed among Asian and Oceanian countries while the remaining 25 percent is assigned to countries outside the region. As the bank expands its membership, countries outside of the region can expand their stake, but the portion cannot exceed 30 percent. Each member will be allocated a share of the quota based on the size of their economy.

China, India and Russia are the three largest shareholders, taking a 30.34 percent, 8.52 percent, 6.66 percent stake, respectively. Their voting shares are calculated at 26.06 percent, 7.5 percent and 5.92 percent.

China’s stake and voting share in the initial stage are a “natural outcome” of current rules, and may be diluted as more members join, China’s Vice Finance Minister Shi Yaobin said in an interview with Xinhua.

“China is not deliberately seeking a veto power,” Shi stressed.

Being the largest shareholder does not mean China will have veto power over major issues. Instead, China will closely watch and balance other members’ interests, said Tang Min, with Counselors’ Office of the State Council, who previously worked for the Asian Development Bank (ADB).

Speaking at Monday’s ceremony, Finance Minister Lou Jiwei said the new bank will uphold high standards and follow international rules in its operation, policies and management to ensure efficiency and transparency.

The bank, headquartered in Beijing, will possibly set up regional offices in other countries. It will be led by a president with a five-year term that can be extended once.

The articles do not say who will be the president, but said the president will be chosen from Asian member countries using an “open, transparent and excellent” selection process.

Jin Liqun, former vice finance minister of China, is secretary-general of the interim multilateral secretariat for establishing the AIIB.

After signing the agreement, representatives from prospective founding countries will return home with the document for legal adoption.

The AIIB was proposed by President Xi Jinping in October 2013. A year later, 21 Asian nations, including China, India, Malaysia, Pakistan and Singapore, signed an agreement to establish the bank.

After the new bank garnered support from countries like Britain and Germany, much focus has been trained on whether the U.S. and Japan, the world’s largest and third largest economies, will join.

While stating that the U.S. will not join the AIIB at present, U.S. President Barack Obama said the country looked forward to collaborating with the new development bank “just like we do with the Asia Development Bank and with the World Bank”in April.

Despite outside worries that a new investment bank will challenge the established order of multilateral lenders, the IMF, World Bank and other leading global lenders have welcomed collaboration with the new bank to fill Asia’s infrastructure gap.

Statistics from the ADB show that between 2010 and 2020, around 8 trillion U.S. dollars in investment will be needed in the Asia-Pacific region to improve infrastructure.

“We view the AIIB as an important new partner that shares a common goal: ending extreme poverty. With strong environment, labor and procurement standards, the AIIB will join us and other development banks in addressing the huge infrastructure needs that are critical to ending poverty, reducing inequalities, and boosting shared prosperity,” World Bank Group President Jim Yong Kim said in a statement after the signing ceremony.

Chinese officials have reiterated that rather than being a competitor, the new bank will complement the current international economic order and enable China to take more global responsibility.

The bank will start operation at the end of the year under two preconditions: At least 10 prospective members sign the agreement and the initial subscribed capital is no less than 50 percent of the authorized capital.

“We are confident of working with related parties to accelerate legal procedures and push for the official set up of the AIIB before the year end,” Lou said.

TIMELINE

October 2013, Chinese President Xi Jinping proposed the bank.

October 2014, 21 Asian nations, including China, India, Malaysia, Pakistan and Singapore signed an agreement to establish the bank.

March 12, 2015, Britain applied to join the AIIB as a prospective founding member, the first major western country to do so. France, Italy and Germany quickly followed suit.

March 31, 2015, China announced that 57 countries joined or applied to join the AIIB as prospective founding members before the deadline.

Until May, five rounds of talks were held and consensus was reached on all key elements, such as the bank’s purpose, membership, capital subscription, voting powers and decision-making structures.

June 29, 2015, delegates of the 57 prospective founding countries of the AIIB gathered in Beijing for the signing ceremony of an agreement to lay the legal framework and management structure for the bank. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

by Matt Burgess

SYDNEY, July 9 (Xinhua) — Maybe it is time for Europe to change policy and officially recognize China as a market economy to further the China-EU trade relationship, said former Italian Prime Minister Enrico Letta.

The key issue to creating links in the China-EU relationship is China’s market economy status, Letta told Xinhua in an exclusive interview here.

Analysts believe this status could be approved in 2016, a year Letta predicts will be a major turning point for the China-EU relationship.

“It could be recognizing by the EU of the market economy status, it could be the year we can launch the free trade agreement (FTA) negotiations,” Letta said.

Chinese Premier Li Keqiang made a strong appeal for the early conclusion of a bilateral trade agreement with the EU at the recent China-EU summit in Brussels at the end of June.

However, establishing a China-EU FTA will be a very complicated process, Letta said.

“There are many fields from agriculture to protection of intellectual property and so on and we need to solve all together, ” Letta said.

Engagements in the China-led Asian Infrastructure Investment Bank (AIIB) as well as the “Belt and Road” strategy are important steps in strengthening Europe’s economic ties with Asia, Letta said.

The Silk Road Economic Belt, together with the 21st-Century Maritime Silk Road, commonly known as the “Belt and Road” initiatives, were proposed by Chinese President Xi Jinping in 2013.

“I think (the AIIB) was an important and decisive step on behalf of the Chinese leadership,” Letta said. “It was important

for EU countries to follow this step, to react in a positive mode. This is why Italy as well as the main EU countries decided to apply for the membership.”

Letta, who is a visiting scholar at the University of Technology, Sydney, said Europe is too focused on domestic political issues, such as the Greek debt crisis, which is taking up too much of the member states’ energy.

“I think the EU must focus the great opportunities we have around the world,” Letta said.

In an on-stage conversation with former Australian Foreign Affairs minister and Director of the Australia-China Relations Institute (ACRI) Bob Carr at the University of Technology, Sydney on Tuesday night, Letta said “I exactly think that the future of the world will be Asian-driven,” noting that was why he is in Australia.

Letta said Australia was not susceptible to the “virus,” the global financial crisis, because of the links with the Asian region.

“We need, as all western countries, change our mind, change our way to do business and to try to create permanent links,” Letta said. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

BEIJING, July 9 (Greenpost) — China’s consumer inflation ticked slightly higher in June while at wholesale level, deflation remained a problem for a 40th month in a row, official data showed on Thursday.

China’s consumer price index (CPI), a main gauge of inflation, edged up 1.4 percent in June, slightly above market forecasts of 1.3 percent and a 1.2-percent rise in May, according to the National Bureau of Statistics (NBS).

On a monthly basis, consumer prices in June remained unchanged, compared with a dip of 0.2 percent posted in May.

NBS statistician Yu Qiumei attributed the pick-up to a lower comparative base from June last year and higher prices of food, including vegetables and pork.

For the first half of the year, CPI edged up 1.3 percent year on year.

Minsheng Securities forecast that China’s CPI growth will continue accelerate in the second half, to around 2 percent in the last quarter, but remain under the government’s annual target of 3 percent set for the year.

The producer price index (PPI), a measure of costs for goods at the factory gate, fell 4.8 percent year on year in June, widening from the 4.6-percent drop seen a month earlier.

The reading also marked the 40th straight month of decline.

“This showed industrial demand is worsening, and China continues to face prominent deflationary risks,” noted Qu Hongbin, chief China economist at HSBC.

Wen Bin, chief researcher with China Minsheng Bank, said the data pointed to continuously weak domestic demand in the economy, adding there is still room for the central bank to ease its monetary policy.

China’s economy grew at its lowest rate in six years in the first quarter, expanding 7 percent, weighed down by a housing market downturn, weak domestic and external demand and overcapacity.

To bolster growth, the Chinese government has unveiled measures including four interest rate cuts since November, accelerated fiscal spending and industrial reforms.

However, analysts predict growth will slip further in the second quarter to below 7 percent as the impact of these pro-growth measures has yet to spread. Second-quarter GDP data is due on July 15.

Given the weak growth, Qu predicted an interest rate cut by 25 basis points and 100-basis-point reductions in banks’ reserve requirement ratio in the third quarter.

Recent stock market volatility has cast a further shadow on the world’s second-largest economy, with its key Shanghai index shedding nearly one third since a June peak.

A batch of supportive policies has been rolled out in the past week to revive investor confidence, including asking 21 major securities brokers to spend 128 billion yuan (about 21 billion U.S. dollars) on exchange traded funds that track the performance of blue chip stocks.

The benchmark Shanghai Composite Index opened 2.13 percent lower on Thursday, but turned positive to close the morning trading session by rising 1.3 percent. The market staged a strong rally minutes after the afternoon trade started.

As of 13:30, the benchmark Shanghai Composite Index surged nearly 5 percent while the Shenzhen Component Index gained 4 percent. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

Interview: Europe should recognize China as market economy to further bilateral relationship: former Italian PM

by Matt Burgess

SYDNEY, July 9 (Xinhua) — Maybe it is time for Europe to change policy and officially recognize China as a market economy to further the China-EU trade relationship, said former Italian Prime Minister Enrico Letta.

The key issue to creating links in the China-EU relationship is China’s market economy status, Letta told Xinhua in an exclusive interview here.

Analysts believe this status could be approved in 2016, a year Letta predicts will be a major turning point for the China-EU relationship.

“It could be recognizing by the EU of the market economy status, it could be the year we can launch the free trade agreement (FTA) negotiations,” Letta said.

Chinese Premier Li Keqiang made a strong appeal for the early conclusion of a bilateral trade agreement with the EU at the recent China-EU summit in Brussels at the end of June.

However, establishing a China-EU FTA will be a very complicated process, Letta said.

“There are many fields from agriculture to protection of intellectual property and so on and we need to solve all together, ” Letta said.

Engagements in the China-led Asian Infrastructure Investment Bank (AIIB) as well as the “Belt and Road” strategy are important steps in strengthening Europe’s economic ties with Asia, Letta said.

The Silk Road Economic Belt, together with the 21st-Century Maritime Silk Road, commonly known as the “Belt and Road” initiatives, were proposed by Chinese President Xi Jinping in 2013.

“I think (the AIIB) was an important and decisive step on behalf of the Chinese leadership,” Letta said. “It was important

REYKJAVIK, July 3 (Greenpost) — China’s Geely Holding Group, known as the world’s leading methanol vehicle manufacturer, inked a deal on Friday to make an investment of 45.5 million U.S. dollars in three years to Iceland’s Carbon Recycling International (CRI), known as the world leader in power to methanol technology.

Addressing the agreement signing ceremony, Li Shufu, founder and chairman of Geely Holding Group, said, “it is no doubt that methanol will be widely used as its advantages compared with gasoline fuel will be more and more prominent. I believe the cooperation with CRI will greatly promote Geely’s development in clean energy for vehicles.”

CRI produces renewable methanol, marketed under the Vulcanol brand, from carbon dioxide, hydrogen and electricity for energy storage, fuel applications and efficiency enhancement.

Methanol is a clean burning, high octane fuel that can be blended with gasoline for automobiles and used in the production of biodiesel or fuel ethers and reduces carbon emissions by more than 90 percent compared to fossil fuels.

“The investment of Geely to CRI will enable carbon recycling expand into China as well as into Europe. It will accelerate the deployment of our technology in China as well as in Europe. It will facilitate the development of methanol fuel cars,” said K-C Tran, chief executive officer of CRI.

Geely became the first auto manufacturer in China to begin conducting research and development into methanol vehicle solutions in 2005, and has since acquired dozens of patents.

It’s Englon SC7 sedan was the first methanol-fuelled car to receive approval from China’s ministry of industry and information technology.

Scientific studies indicate that methanol-fuelled cars generate as much as 80 percent fewer fine particulate matter (PM2.5) emissions than traditional gasoline-powered equivalent and cost an average of 40 to 50 percent less to fuel.

“In this sense, Geely group is a natural investment partner for CRI. With the deepening of this partnership, we will explore the possibility of promoting methanol vehicles that will meet local standards here in Iceland and other European countries,” Li added.

Describing Geely’s cooperation with CRI as an important practice to realize their commitment to the global sustainable development, Li said, “Geely is unique in researching and manufacturing methanol vehicles around the world, and so is CRI in converting carbon dioxide into methanol. The cooperation between these two companies will promote the development of the clean energy and the carbon cycle economy.” Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

XI’AN, July 5 (Greenpost) — Xi’an Shaangu Power, a Chinese engineering company based in northwestern Shaanxi province, paid 318 million yuan (51 million U.S. dollars) for a 75 percent stake of Brno Ekol, a leading Czech turbine manufacturer.

According to an agreement signed by the two companies in January, the acquisition will take place in two steps, with delivery of the remaining stake completed in the years to come.

It is the biggest amount paid by China into Czech’s manufacturing industry over the recent years, accounting for about 17 percent of China’s total investment into the European country.

Shaangu Power, established in 1999, is a major industrial compressor producer in China. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

LONDON, July 3 (Xinhua) — Pigs will fly, the old saying goes, and for Britain, pork exports to China have given the economy a boost, government environment secretary Elizabeth Truss announced Friday.

Global pork exports from Britain have rocketed 44 percent in the last five years generating almost 334 million U.S. dollars a year for the British economy, the minister said.

Truss said the pork industry was given a significant boost after the British government opened up pork trade with China in 2012. The exports to China are now worth 47 million dollars each year.

Visiting the country’s biggest pork exporter, Cranswick Country Foods in the Hull (Northern England), Secretary Truss praised the industry for grasping export opportunities and leading the way in new Chinese markets, setting a gold standard for the rest of the UK food industry.

She said exports of British pork around the world are up from 149 million pounds in 2010 with China being by far the biggest international export market for British pork.

Truss said: “UK food has an excellent reputation the world over, and China presents a fantastic opportunity for our farmers to take advantage of a growing demand for top-class British produce.”

“China is now one of the UK’s fastest-growing export markets … Pork is a significant British export, along with whisky, salmon, and fresh fish,” said Truss.

In January, Truss visited China to discuss opening up the market further for British exports and expanding the number of British plants that can export pork to China.

As part of the trip, she discussed pigs trotters, which could bring an additional 11.7 million dollars a year for the British pork industry; negotiations with China are currently ongoing, she said.

The new UK Agriculture and Food Counsellor, Karen Morgan, has been tasked with driving greater access to China’s growing food market.

This paves the way for the dairy industry where British dairy products are in growing demand. Dairy exports to China are now worth over 37 million dollars and infant milk formula and processed cheese could present an opportunity for British producers to diversify. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

LONDON, July 6 (Greenpost) — London Stock Exchange Group (LSEG) Monday announced that it has witnessed the first Euro-denominated bond by a Chinese issuer admitted to trading on its markets.

Bank of China (BoC) has issued a 500-million-euro (or 550 million U.S. dollars) bond listed in London, through its Hungarian branch, as part of wider bond issuance program by the bank to provide funding for China’s ‘One Belt, One Road’ projects, said LSEG.

The project aims at boost links and commerce between China and countries along the old land-based and maritime silk routes, noted the group.

Nikhil Rathi, Director of International Development at LSEG said in a statement: “This latest Euro-denominated bond, a first for a Chinese issuer, demonstrates London Stock Exchange’s apposition as the leading gateway for Chinese firms looking to access European and global capital in the full range of currencies.”

Chen Huaiyu, General Manager of Bank of China Hungarian Branch said: “The success of the bond issued by Bank of China Hungarian Branch shows that international investors have great confidence in the CEE region and also in the ‘One Belt, One Road’ projects initiated by China in this region.

“Bank of China will accelerate the establishment of branches in CEE countries and will provide more financial support to this region in the future,” added Chen.

According to LSEG’s data, fifty-seven Chinese companies are currently quoted in London, with eight on the Main Market and 49 on Alternative Investment Market. In addition, thirty-two so-called dim sum bonds, or offshore RMB-denominated bonds, are traded on London Stock Exchange’s market, with a aggregate value of RMB 24 billion. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

Chinese company acquires Czech turbine manufacturer

XI’AN, July 5 (Greenpost) — Xi’an Shaangu Power, a Chinese engineering company based in northwestern Shaanxi province, paid 318 million yuan (51 million U.S. dollars) for a 75 percent stake of Brno Ekol, a leading Czech turbine manufacturer.

According to an agreement signed by the two companies in January, the acquisition will take place in two steps, with delivery of the remaining stake completed in the years to come.

It is the biggest amount paid by China into Czech’s manufacturing industry over the recent years, accounting for about 17 percent of China’s total investment into the European country.

Shaangu Power, established in 1999, is a major industrial compressor producer in China. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

BEIJING, July 7 (Xinhua) — A total of 220 Chinese firms conducted successful initial public offerings (IPOs) on both domestic and overseas capital markets in the first half of this year, accounting for 45.2 percent of global total, raising 37.96 billion US dollars, accounting for 57 percent of global total, according to statistics from investment research company Zero2IPO.

Globally, 487 companies conducted IPOs during H1, up 52.7 percent year on year, raising 66.609 billion US dollars, down 25.3 percent year on year, said Zero2IPO on Tuesday.

Among the 220 Chinese enterprises, 187 were listed on China’s A-share market, raising 23.572 billion yuan. In a breakdown, 78 were listed on the Shanghai Stock Exchange and 74 were listed on the SME board of the Shenzhen Stock Exchange.

Meanwhile, 33 Chinese enterprises were listed on 5 overseas capital markets, raising 14.388 billion yuan, up 42.8 percent year on year. Enditem

BEIJING, July 7 (Xinhua) — China’s newly-established free trade zones (FTZs) in Guangdong, Tianjin and Fujian have shown promise in attracting overseas investment, the commerce ministry said on Tuesday.

At the end of May, over a month after their establishment, the three zones had received a combined 22.6 billion yuan (about 3.7 billion U.S. dollars) in contracted overseas investment, Ministry of Commerce spokesman Shen Danyang told a press conference.

The Guangdong, Tianjin and Fujian FTZ attracted 7.8 billion yuan, 11.7 billion yuan and 3.2 billion yuan, accounting for 45.3 percent, 69.4 percent and 53.6 percent of the total in their respective regions, Shen said.

The three FTZs were set up in April, 18 months after the first FTA was established in Shanghai as part of the government’s efforts to test reform policies and better integrate the economy with international practices in a landscape where China’s old export-reliant model is no longer sustainable.

Some of the new rules and regulations, launched for trial in the FTZs, promised easier access to both foreign and domestic investment, further opening up of the service sector and liberalizing measures for the financial sector. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson

BEIJING, July 7 (Greenpost) — China’s non-financial investment in the European Union hit 4.21 billion U.S. dollars in the first five months of the year, up more than 367 percent year on year, the Ministry of Commerce (MOC) said on Tuesday.

The figures suggest China’s investment in Europe has entered a period of rapid growth, said MOC spokesman Shen Danyang at a press conference in Beijing.

He said that the rise is due to Chinese companies’ increasing investment projects in Europe, such as the stake acquisition of Italian tire maker Pirelli by China’s state-owned National Chemical Corp.

“At the same time, Chinese investment in Europe is also broadening to areas including machinery, autos, real estate, shipping, telecommunications, energy, and finance,” Shen said.

China-EU financial cooperation also appears promising, he said, as EU nations including Britain, France, Germany and Italy have all joined the China-led Asian Infrastructure Investment Bank, while the EU welcomes China’s participation in its strategic investment plan.

During his visit to Europe last week, Chinese Premier Li Keqiang proposed China and EU make full use of a currency-swap scheme worth more than 700 billion yuan to facilitate bilateral economic and trade cooperation. He also said China will improve the RMB Qualified Foreign Institutional Investor program, a channel for overseas investment in the Chinese stock market.

Shen added that China’s Belt and Road initiative and its Internet Plus strategy, a national digital drive, have much in common with the industrial upgrading and smart city building plans of many EU countries, indicating more room for industrial cooperation between the two sides. Enditem

Source Xinhua

Editor Xuefei Chen Axelsson